-“We’ve found an issue with your telecare alarm, and we need immediate payment to fix it.”

-“The Digital Switchover is here, you need to make a one-off payment to ensure your telecare alarm stays up-to-date.”

-“Your current telecare provider has gone out of business, and we need your bank details to set up a new direct debit.”

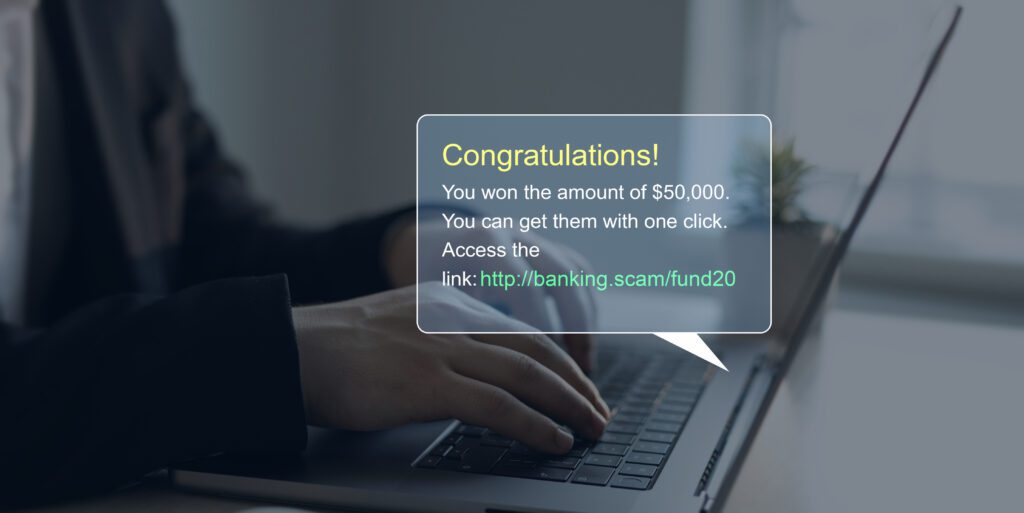

These are just some of the false statements scammers use to try and con people out of their hard-earned money. And sadly, many are falling victim to these scams. It is important to be aware of these scams and to take the time to research any offer before committing to it. It is also important to remember that if it looks too good to be true, it probably is.

The UK has the highest rate of scam calls in Europe, with nearly 1 in 10 calls being a scam. Given these figures, it’s important now more than ever that we understand exactly what phone scams are and how we can protect ourselves from them.

Not every unexpected phone call we receive is a scam. For example, a cold call is when somebody calls you unexpectedly, usually trying to sell you something. While these can be nuisances, they’re not necessarily scammers. But how can you tell it’s not a scam?

The main difference between a cold call and a scam call is typically their intention or purpose. Cold calls are made by legitimate companies, offering things like insurance, home repairs, or financial services. These calls are usually legal, as long as they conform to specific guidelines, like those from the Telephone Preference Service (TPS), which lets people opt out of such calls.

Scam calls, however, aim to con people out of their money or personal information. Scammers use deceitful tactics, pretending to be somebody they’re not. For example, a scammer might pretend to be from the tax office, tech support or another organisation, demanding immediate payment.

Scammers often try to create a sense of urgency or use threats to make you act quickly. They might ask for sensitive details like your credit card number or other personal information.

Understanding the difference between cold calls and scam calls is important in protecting yourself from being the victim of a scam, especially if you’re an older person. There has been an increase in reports about older individuals receiving phone calls from scammers regarding personal alarm systems.

Some alarm users have received calls from scammers telling them that they need to make a payment to update their devices during the digital switchover. Unfortunately, many scammers see older people as easy targets. Why?

- Finances. Older adults tend to have more savings than most young people, and they are more likely to own their own homes. Such factors can be appealing to scammers.

- Loneliness. Many older ones live alone or don’t socialise regularly because of health limitations. This can make them more open to scams that prey on loneliness and the desire for connection.

If loneliness is affecting you or somebody you know, please take a look at our blog – You Can Live Alone But Not Be Lonely — How? - Cognitive Decline. As people age, they may experience memory issues or difficulty in thinking clearly, which can make it hard to spot scams. Scammers often use tricky methods that are hard to detect, especially for those who may have conditions like dementia.

- Difficulties with Technology. Many older adults didn’t grow up with the internet and may struggle with new technology. This can make them more likely to fall for online scams, such as fake emails or websites.

A recent survey conducted by Age UK with 10,000 participants found that 41% of people over the age of 50 reported being scammed in the past five years. Those who lost money averaged about £2,022, and a significant number, 22%, never got their money back.

But falling victim to a scam does more than hurt your bank account. The stress and anxiety that come with losing money can lead to health problems, both mental and physical, and sometimes this can even require more assistance or care. Older adults and their families need to know about these risks and take precautions against scams.

Protect Yourself from Scammers

There are many steps you can take to avoid falling victim to a scam. An important starting point is to reduce the number of nuisance calls you receive. Here are two ways you can do this:

- Sign up for the Telephone Preference Service (TPS). TPS is a free service enabling people to opt out of certain calls. When you register, your number will be added to a list that tells companies not to call you with marketing offers. It’s actually illegal for salespeople to call numbers that are on the TPS list.

- Use Call Blocking Options. Most phone companies provide a free service to help block unwanted calls from suspicious numbers. Check with your phone provider to see if they have this service. If they don’t, there are devices and apps you can buy that help you avoid unwanted calls.

If you struggle with technology, why not ask a friend or family member to help you set up these features? And in the meantime, here are some additional ways you can protect yourself from scams:

- Ignore Unknown Numbers. If you get a call from a number you don’t recognise, let it go to voicemail. Many scammers use unfamiliar or fake numbers to trick people.

- Hang Up on Suspicious Calls. If someone on the phone asks for personal information or pressures you to pay for something immediately, it’s best to hang up right away.

- Verify the Caller. If you’re not sure about a call, hang up and contact the company or organisation directly using the phone number on their official website to ensure you’re reaching the right place.

- Report Scam Calls. If somebody does try to scam you over the phone, you can report them to ActionFraud, supported by the ICO (Information Commissioner’s Office).

How the ICO is Fighting Back

The ICO (Information Commissioner’s Office) is an independent UK organisation that protects individuals’ data rights. They ensure compliance with data protection laws like the General Data Protection Regulation (GDPR) and help resolve privacy complaints.

The ICO offers guidance to businesses on handling personal data and provides advice to individuals on protecting their information and understanding their rights. They place great emphasis on fighting scams and fraud. Part of their efforts include:

- Encouraging businesses to share personal information sensibly and safely, protecting their customers from scams.

- Offering practical guidance in helping organisations understand how to handle personal data while working to fight scams and frauds.

- Collaborating with various public and private organisations to spot and stop fraud. Part of this effort involves sharing information to help identify people who might be at risk of scams and putting in extra checks to prevent fraud.

Overall, this campaign stresses the importance of working together and sharing information responsibly to protect people and reduce the harm caused by scams and fraud.

You can help make a difference by reporting any suspicious phone calls you receive. If you notice something strange, please let the Information Commissioner’s Office know. You can provide details like the names of the companies involved and the phone number they called from. Your reports can help keep everyone safe.